Imf Angola Outlook

angola outlook wallpaperIMF approves 4875 mln aid to Angola The International Monetary Funds executive board announced Monday it had approved the disbursement of 4875 million to Angola which is suffering from low. This page has economic forecasts for Angola including a long-term outlook for the next decades plus medium-term expectations for the next four quarters and short-term market predictions for the next release affecting the Angola economy.

Http Www Imf Org Media Files Publications Weo 2019 October English Text Ashx La En

The revision reflects better-thananticipated second quarter GDP outturns mostly in advanced economies where activity began to improve sooner than expected after lockdowns were scaled back in May and June as well as indicators.

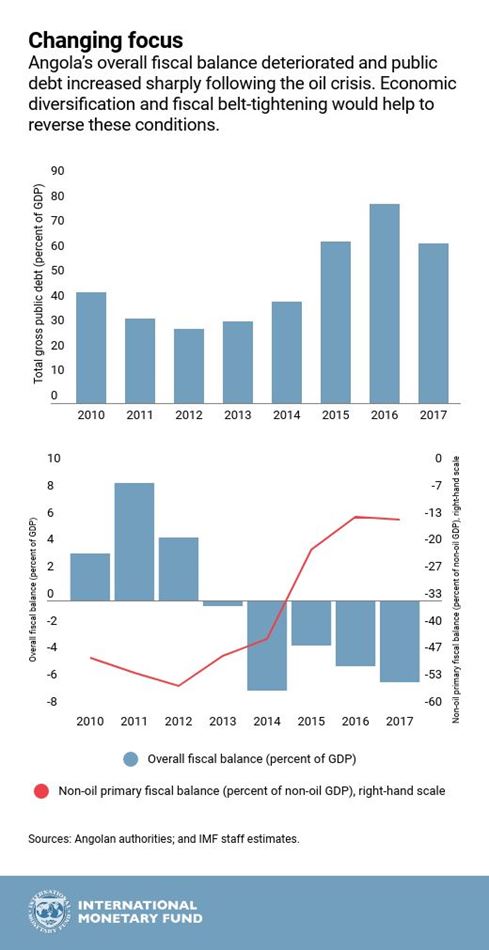

Imf angola outlook. On September 16 2020 the IMFs Executive Board approved the third review under the EFF and additional financial support to Angola to help mitigate the impact of the crises. Outstanding Purchases and Loans SDR. Low oil prices and declining output volumes weigh on government and export revenue although external assistance is coming in and economic opportunities for many are limited amid a sustained recession.

The IMF projects that the economy of Algeria with high debt levels and a nearly empty sovereign wealth fund that was valued at more than 70 billion just seven years ago to contract by 52 this year and grow by a miraculous 62 in 2021. The reform agenda under the current IMF programme has stalled and protests are common as dissatisfaction with the government grows. Global growth is projected at 44 percent in 2020 a less severe contraction than forecast in the June 2020 World Economic Outlook WEO Update.

Your browser is not up-to-date. With 189 member countries staff from more than 170 countries and offices in over 130 locations the World Bank Group is a unique global partnership. An uneven recovery All together including China output in emerging market and developing economies is set to decline by 33 this year -02ppt vs June WEO update followed by a 60 recovery in 2021 02ppt.

IMF World Economic Outlook October 2020 ING - Fiscal year basis for India Growth. Angola continues to face a deteriorated external environment which is weighing on the economic outlook. Transcript of IMF Press Briefing.

Angola is expected to remain in recession in 2020 due to the recent plunge in oil prices and the global slowdown resulting from the impact of COVID-19. The International Monetary Fund IMF on Monday forecast an economic turmoil for Angola in 2020 amid COVID-19 pandemic. Accordingly the IMF has provided 1 billion to Angola bringing its total expected financial support to about 45 billion under the three-year program.

This paper discusses Angolas Second Review of the Extended Arrangement Under the Extended Fund Facility Requests for a Waiver of NonObservance of Performance Criteria Modifications of Performance Criteria and Financing Assurances Review. 2021 Projected Consumer Prices Change. The head of the International Monetary Fund said on Monday the global economic outlook remained highly uncertain given the coronavirus pandemic and a growing divergence between rich and poor.

Global growth is projected at 44 percent in 2020 a less severe contraction than forecast in the June 2020 World Economic Outlook WEO Update. For optimum experience we recommend to update your browser to the latest version. Financial support from the IMF.

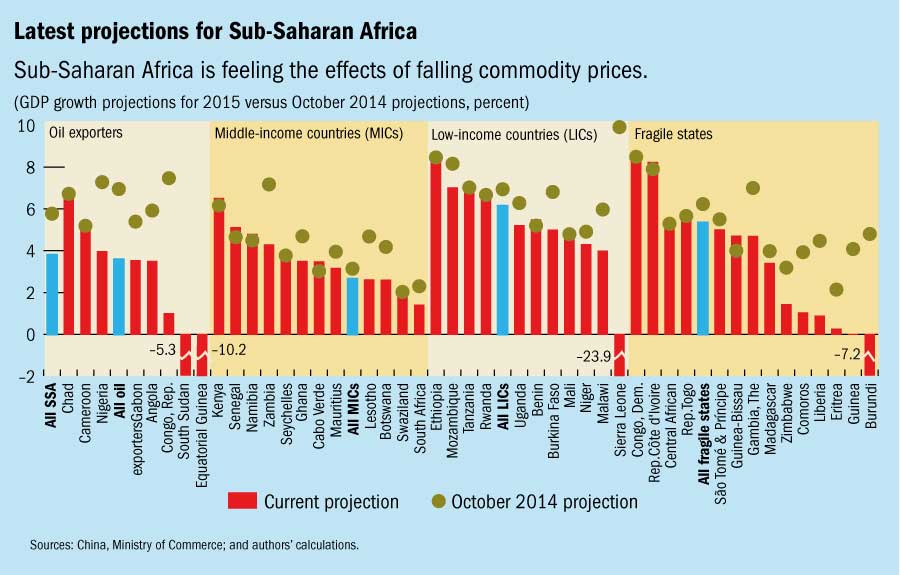

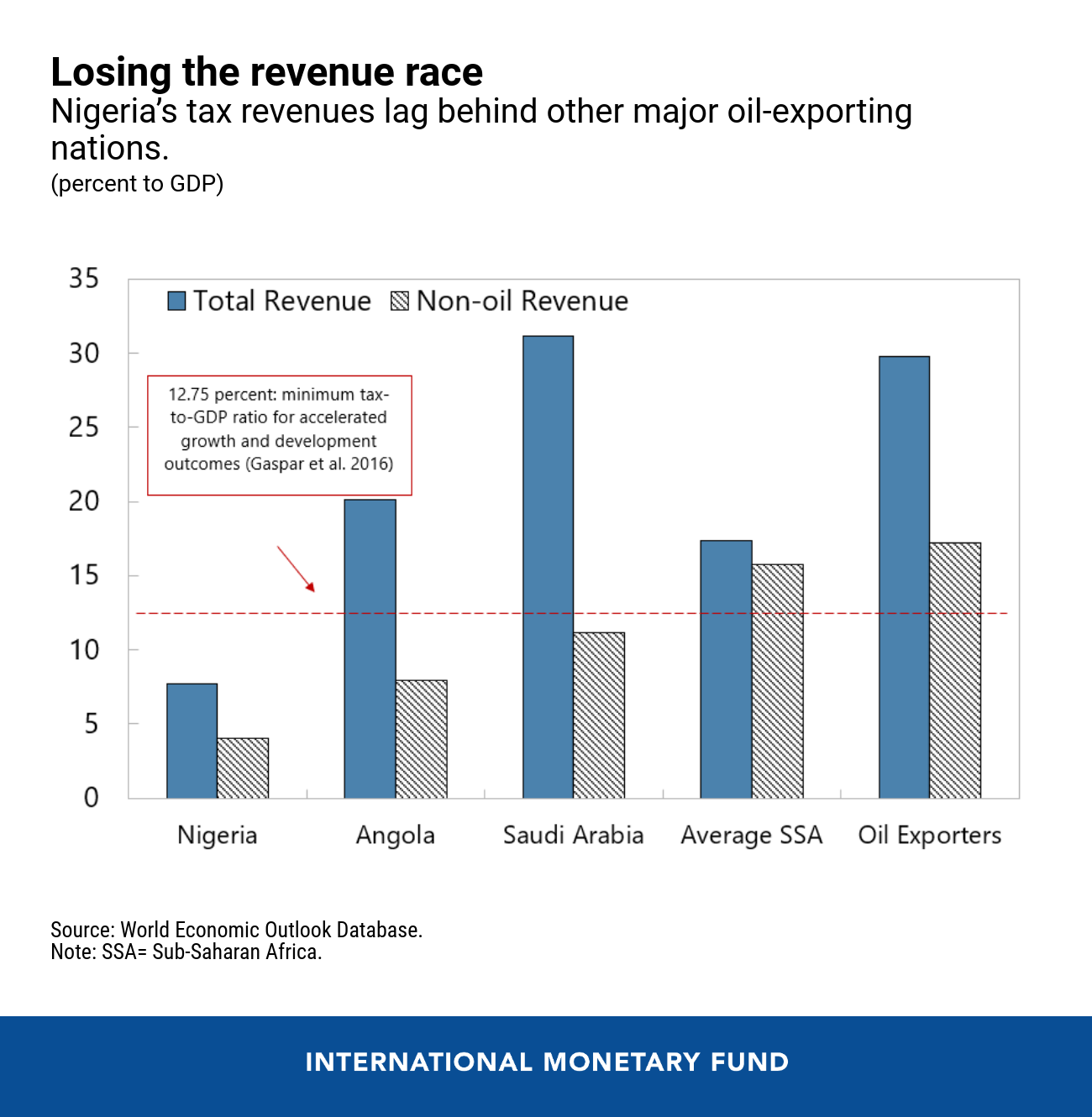

The IMF has approved the second review of its largest program in sub-Saharan Africa. Moreover the all-important oil sector contracted for the 17th consecutive quarter. IMF said in its latest regional economic outlook for Sub-Saharan Africa that the Angolan economy would shrink by 4 percent more than double the contraction expected in April.

A report issued by the IMF on Monday following a recent research mission predicted that on current policies the medium-term growth outlook would remain subdued accompanied by muted inflationary. The economic downturn worsened markedly in Q2 at the hands of the pandemic which battered domestic and foreign demand. World Economic Outlook October 2020 The International Monetary Fund.

It has given the green light to continued financial support to Angola under the Extended Fund Facility. An Asset Quality Review AQR was conducted with the support of IMF and has indicated that the financial sector is sound. The unemployment rate rose further which coupled with spiraling inflation will have weighed on private consumption.

18047 million December 31 2020 Special Drawing Rights SDR. This will mean about 15 billion disbursed of a planned total of 37 billion. Turning to Q3 data continued to paint a bleak picture.

IMF Executive Board Completes Fourth Review of the Extended Fund Facility Arrangement for Angola and Approves US 4875 Million Disbursement. Five institutions working for sustainable solutions that reduce poverty and build shared prosperity in developing countries.

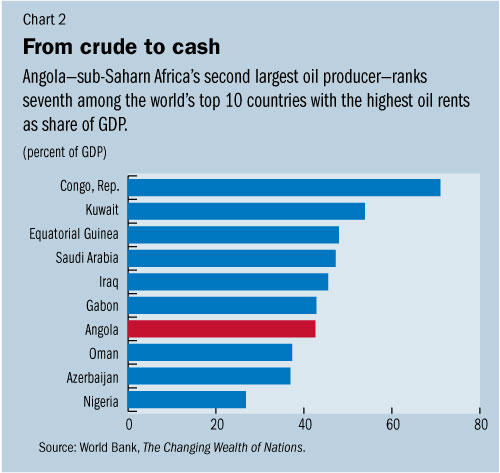

Why Is Angola Seeking An Imf Loan Now Focuseconomics Insights

Why Is Angola Seeking An Imf Loan Now Focuseconomics Insights

Imf Postpones Discussion Of Loan Enhancement Until Second Half Of August Ver Angola Daily The Best Of Angola

Imf Postpones Discussion Of Loan Enhancement Until Second Half Of August Ver Angola Daily The Best Of Angola

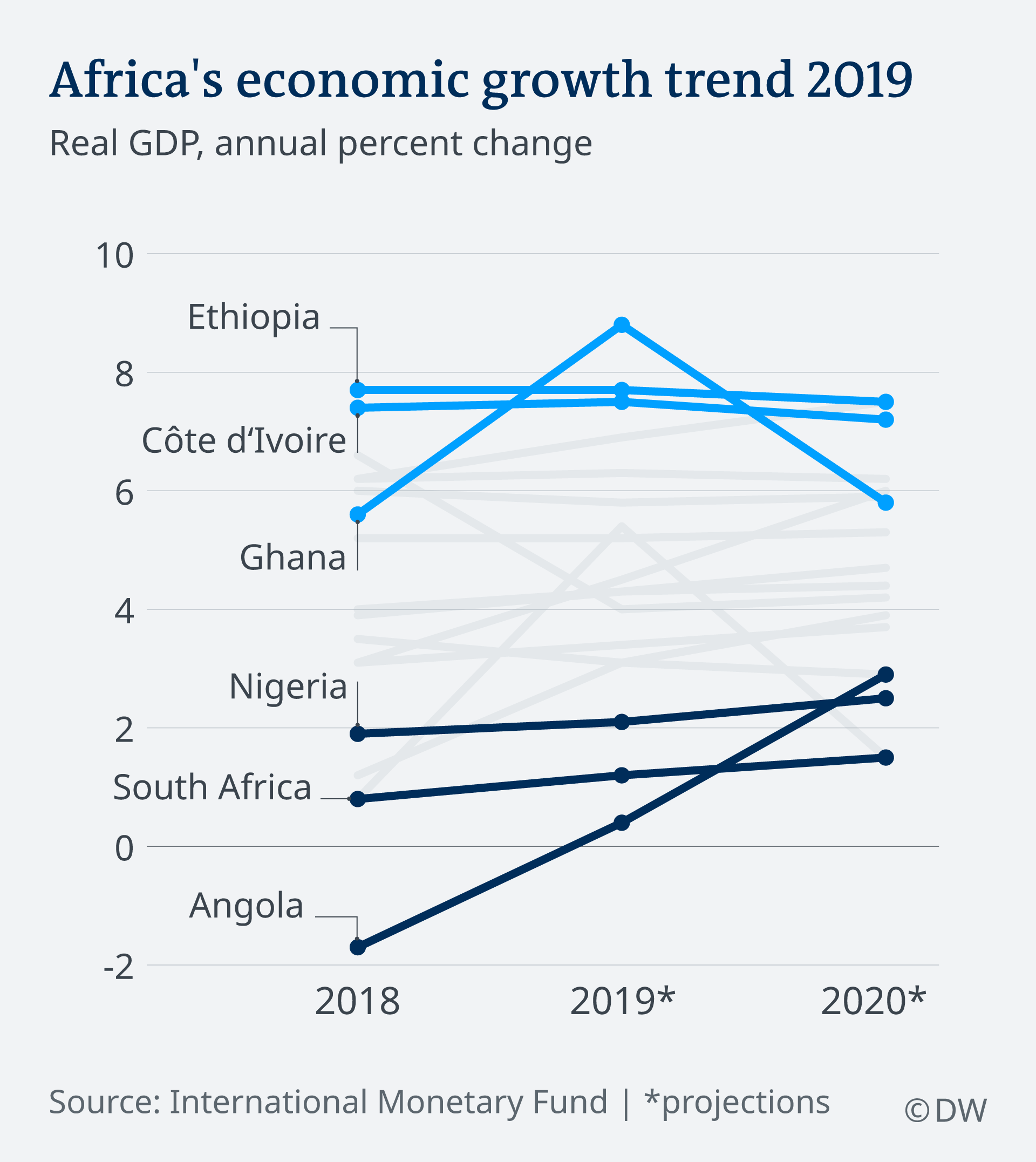

Imf World Economic Outlook Puts Ghana In The Lead Africa Dw 17 04 2019

Imf World Economic Outlook Puts Ghana In The Lead Africa Dw 17 04 2019

Angola Forecast Gdp Ppp Per Capita 1980 2021 Data

Relief As Imf Disburses 488 Million To Angola

Relief As Imf Disburses 488 Million To Angola

The Imf Has Altered Its Outlook On Africa This Is What S Changed Africa Ontherise

The Imf Has Altered Its Outlook On Africa This Is What S Changed Africa Ontherise

China Is Behind Billion Dollar Debt Restructure For Angola Analysts Say South China Morning Post

China Is Behind Billion Dollar Debt Restructure For Angola Analysts Say South China Morning Post

Imf Media Center Imf World Economic Outlook January 2021 Forecast

Imf Media Center Imf World Economic Outlook January 2021 Forecast

Imf Gdp Growth Forecasts Vs Focuseconomics Consensus Forecast

Imf Gdp Growth Forecasts Vs Focuseconomics Consensus Forecast

Imf Trims Malawi Growth Forecast The Nation Online Malawi Daily Newspaper

Angola Forecast Nominal Gdp Per Capita 1980 2021 Data