Join Navy Student Loan

join loan student wallpaperYou may receive 3 payments paid to your loan provider annually on your enlistment date. For applicants who qualify the Army will pay up to 65000 of student loans as will the Navy although the Navy earmarks payments for loans taken to fund post-secondary education.

Nrotc Scholarships Navy And White Scholarships Study Tips College

Nrotc Scholarships Navy And White Scholarships Study Tips College

Remember you need to apply and join the program before beginning active service.

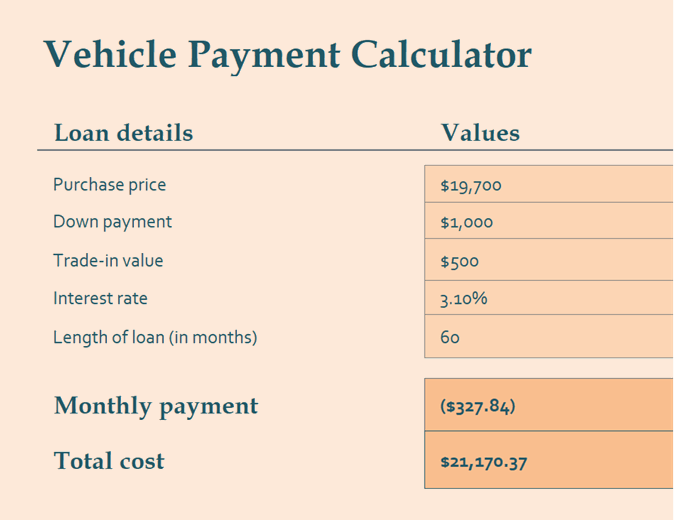

Join navy student loan. The catch is the loan has to be a federal stafford loan the Navy can pay off up to 6000000 in federal student loans. The Navy offers a Student Loan Repayment Program. Navy service members may receive up to 65000 over the course of three years.

The program features perks such as competitive interest rates favorable cosigner terms and minimal fees but youll have to meet strict eligibility requirements to have access. You can join the Navy with your debt in fact you might be able to have the Navy pay off your student loans. Active-duty Army members are eligible for up to 65000 in student loan repayment assistance.

Federal loan consolidation is for students who are in repayment status or parents who wish to extend the repayment period on their current PLUS and obtain a fixed interest rate for the life of the loan--you can combine all of your eligible federal student loans into one loan with a Federal Consolidation Loan. While the military offers plenty of options for paying or eliminating your student loans you have other options. The Army Navy and Air Force offer programs to help soldiers pay back their student loans.

You must be Non-Prior Service a High School Diploma Graduate get at least a 50QT on your ASVAB test and qualify for and enlist in one of the LRP qualifying ratings. Military Loan Repayment Programs. This program offers up to 80000 over a two-year period to repay pharmacy student loans.

Navy Federal reserves the right to approve a lower amount than the school-certified amount or withhold funding if the school does not certify private student loans. The Indian Navy is a well balanced and cohesive three dimensional force capable of operating above on and under surface of the oceans efficiently safeguarding our national interests. Current ratings and programs eligible for SLRP.

You should have more reasons to join the military than just the student loan assistance. The program makes three yearly payments during the first years of a sailors service. As of June 1 2017 the Musician rating is eligible for the SLRP incentive.

Be part of something bigger than yourself. The previously mentioned enlistment bonuses can help there though they are not directly associated with student loans. The Navy Loan Repayment Program NLRP is among the list of incentives Navy recruits enjoy to assist them in affording federal student loans of up to 65000.

Joining the military is a huge life-changing decision. To qualify you must have had the loan prior to enlisting in the Navy. Pros and Cons of Joining the Military for Student Loan Forgiveness.

The new ratings and programs now include Nuke AIRR-ATF EOD-ATF ND-ATF SB-ATF SO-ATF CTI-ATF IT-ATF ITS-ATF IT-SG MT-AEF SECF-5YO CTM-SG CTN-ATF CTR-SG CTT-AEF CTT-SG and STG-AEF who join active duty and ship to boot-camp before May 31 2020. Student Loan Repayment The Student Loan Repayment Program LRP remains available for the Musician rating who join and ship at any time. Navy Federal private student loans are subject to credit qualification school certification of loan amount and students enrollment at a Navy Federal-participating school.

Pharmacy graduates who commission in the Navy receive a 30000 sign-on bonus and an opportunity to participate in the Navy Health Professions Loan Repayment Program. The best-known is the military college loan repayment program CLRP. Navy Student Loan Repayment Program Help The Loan Repayment Program is one of several Navy enlistment education incentive programs designed to pay federally guaranteed student loans up to 65000 through three annual payments during a Sailors first three years of service.

Navy Student Loan Repayment Program. The Navy Federal Credit Union student loans consolidation program offers much-needed debt relief for its members. The student loan assistance programs below though are specifically for military student loan repayment which means you have already accrued debt from college and are seeking assistance with paying it off.

After your first year of service the Army. Join the military for the chance to. If youre buried in student loan debt then the Navy loan repayment program provides a fantastic opportunity to reduce your financial liabilities but youll need to be extremely cautious about joining up just to get your loans discharged because eligibility conditions just keep getting more difficult to satisfy.

During a interval of exercise army responsibility your student loan lender will allow you to defer or postpone making funds in your student loan. You also can defer making funds for the 13-month interval that follows the top of energetic responsibility. You must agree to enlist for at least three years.

That student loan repayment program is used as an enlistment incentive for those joining the military and is not available for. To be eligible for the Navy Student Loan Repayment Program LRP you must meet the following. Where student loans are concerned military people have more than one avenue to pay off or pay down their student loans thanks to being in the Army Navy Air Force Marine Corps or Coast Guard.